New York Community Bank Online Banking Login

Technology has made our lives easier in so many ways, which includes a more convenient banking feel. What used to require a bulky check register and monthly newspaper statement is simplified — now you can have care of your banking needs online.

If yous're on the fence about trying online banking, you'd be surprised at how piece of cake it is to figure out. One time y'all set upward your online profile and get familiar with your bank'due south digital services, you'll beloved the convenience. Plus, it may brand information technology easier to track and better classify your spending. Use these tips to make the most of managing your bank account online.

Make Certain Your Personal Information Is Current With Your Banking company

As basic as it sounds, you likely won't be able to bank online if your personal data isn't current and on file with your bank. Most banks crave customers to ostend information via text, email or phone call, so information technology's essential to brand sure that you lot have the most up-to-date data on file.

Accept the time to call or visit your bank, and double-check that your information is correct. Having the right information on file with your bank will not only increment your peace of mind, but it will too make setting upwardly online banking easier. Yous may even be able to get started with online banking while y'all're talking to your bank representative.

Familiarize Yourself With Your Depository financial institution's Online Systems

Before you dive too deeply into online banking, familiarize yourself with your depository financial institution's online tools. Await around the banking company's website, and, if possible, take a virtual tour of the features of online banking. Find out what page to visit to see what's coming into and going out of your bank account. Get acquainted with looking at your business relationship and figuring out how to cheque balances. Learn how to pay your bills online — with the help of a representative over the phone if that simplifies the procedure for y'all.

Y'all'll also want to download your bank's app for online cyberbanking on the go. Make sure yous can navigate your way around the app; it'll probably look dissimilar from the website interface, even if it has the aforementioned functionality.

Once you lot've learned your way around your bank's online organisation, y'all tin can master the basics of online cyberbanking. You tin can run into how your online banking system functions like an old-school cheque register, and you tin view credits and debits without much trouble. You tin can also track and manage any fees that your bank charges you.

Check the website'south homepage menus to find out how to transfer coin between accounts. Your bank may even have a way to transfer money to family or friends who use the aforementioned bank. In your bank's app, you tin can learn how to eolith checks using your smartphone camera. Navigating your way around the online cyberbanking website can alter the way you manage your finances. Easily accessing your business relationship data this way can help you monitor your spending.

Employ Online Banking to Organize Your Expenses

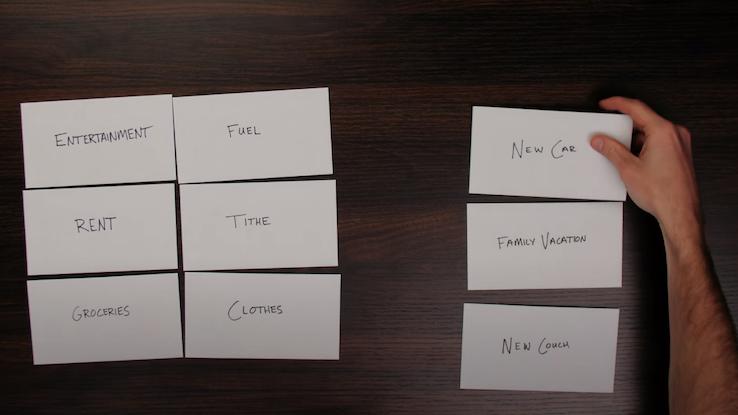

Nigh banks have a handy characteristic in their online platforms that allows users to categorize expenses for easy organisation. These categories tin can help you know what you lot're spending most of your money on. Many banking systems learn your habits and can intuitively classify your purchases for you once yous've set the categories upward.

Categorizing your expenses this mode tin assist you with your budgeting; you tin can meet at a glance how much of your coin goes to specific things. For instance, if you want to spend 10% or less of your budget on entertainment, you can view and rail how much of your spending goes to that category. When it's easier to tell that you may exist overspending, you can take the necessary steps to scale back on those purchases and allocate more money to savings, for example.

Pay Bills Online and Automate Consistent Expenses

Another helpful feature of online banking is the power to pay bills from your figurer or mobile device. No more writing checks or licking envelopes — your bank sends a payment to the person or visitor yous're paying and tracks this activity on the online banking portal. You tin accept care of your bills in i sitting or have your banking concern automatically send payments online without the need for yous to input information for each one.

You tin even automate certain payments that you lot know will be consistent. If you lot accept a bill that never changes every month, you can ready it to pay from your bank at a certain fourth dimension every month. For case, say your $one,200 rent is due on the fifth of each month. In your online cyberbanking portal, you may be able to set upward a recurring payment to your landlord that transfers the coin (or mails out a check) on the first of each month automatically. Online neb pay isn't simply great for bills, because you can likewise pay individuals or handle your charitable giving through your banking company's website or app.

New York Community Bank Online Banking Login

DOWNLOAD HERE

Source: https://www.askmoney.com/investing/how-manage-your-bank-account-online?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: worthendigum1956.blogspot.com